U.S. medical supply chains are fragile in the best of times—COVID-19 is testing their strength

The COVID-19 pandemic has brought medical supply chains into the spotlight. There has been a national shortage of testing kits, and at least one drug is already unavailable because of the outbreak, though it hasn’t been publicly named.

As operations engineers who focus on how these supply chains work, we know that even in the best of times, the U.S. drug supply chain is relatively fragile. Shortages regularly occur, and the COVID-19 pandemic has the potential to further disrupt a system that patients depend on, sometimes for life or death.

A snapshot of how drugs are made

Drugs can be divided into two broad categories: brand name and generic.

Brand name drugs are those that are still patent-protected, like Chantix and Truvada. They’re typically very profitable for manufacturers. This generally leads to a reliable supply of such drugs, often with some degree of redundancy—companies may maintain extra capacity or contract with multiple suppliers to prevent disruptions from causing shortages.

Patents, on the other hand, no longer protect generic drugs like ibuprofen and azithromycin. The profit margins for generic pharmaceuticals are low, and the supply chains for generics with low demand are often fragile. Almost 90% of the U.S. drug supply is generic.

A typical pharmaceutical supply chain begins with a manufacturer of the active pharmaceutical ingredients, or API. API plants are often overseas. China and India are major API producers, particularly for generic drugs. The APIs are then shipped to plants where they are formulated into drugs for shipment to wholesalers, distributors, hospitals, pharmacies and patients.

Supply chains for generic drugs are often lean. Typically each stage holds little inventory, ranging from a few weeks to a few months. The active pharmaceutical ingredient may be made by a single manufacturer, and the finished form of the drug is nearly always made at a single manufacturing plant.

Federal regulatory protections require the API manufacturer, the plant and the line on which the drug is manufactured all to be reviewed by the Food and Drug Administration. This is often a lengthy process.

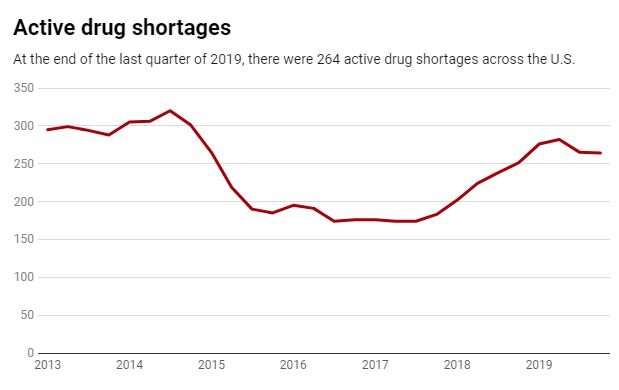

This leanness means that a problem at any stage can disrupt the entire supply chain for months. The average drug shortage lasts 14 months, and some have lasted for over three years. Unfortunately these are not rare events and don’t only happen when there are worldwide pandemics. Within the U.S., hundreds of drugs have been short since 2015 – including cancer treatments, antibiotics and central nervous system agents.

Disruptions can take many forms, and this leads back to the COVID-19 situation. To curtail the spread of the virus, many manufacturing plants in China were closed for weeks. In late February, the FDA announced the first COVID-19-related drug shortage. Other such shortages may well occur.

Making sure the supply chain won’t snap

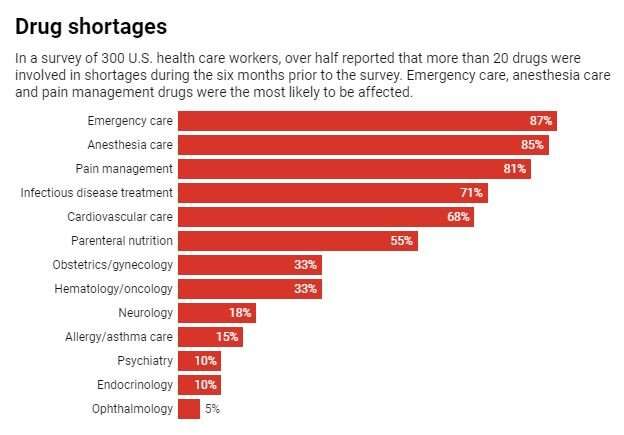

The effects of COVID-19 extend beyond manufacturing. The pandemic may lead to spikes in demand, which may in turn cause shortages. This is what occurred for the test kits: Demand rapidly increased once people needed to be tested. If demand surges for medications as well—such as hydroxychloroquine and chloroquine, which are being eyed as treatments for COVID-19 – there may be shortages even if the supply is unaffected by plant shutdowns.

During the COVID-19 outbreaks, the public can reduce shortages by taking action to manage downstream effects. “Flattening the curve” is about reducing demand spikes to help health systems manage the crisis without becoming overloaded. By washing your hands, physically distancing and not hoarding, Americans can help to limit the spread of the virus and take some of the stress off of hospitals.

Other strategies include extending the available supply. For example, the federal government or pharmaceutical companies could extend drug expiration dates if appropriate, or scientists could develop methods to test multiple people using the same kit.

At a broader scale, the U.S. should put resources into rapidly ramping up production where possible and keeping the supply chains as “connected” as they safely can be—for example, continuing to allow cargo to be shipped between continents even if passengers are not.

In the long term, there are strategic steps manufacturers can take to reduce drug shortages. Decentralizing supply chains could help counter upstream disruptions. Rather than producing a drug in a single plant, companies could distribute production across multiple plants, ideally in different areas of the world. This could prevent a single problem from affecting the entire supply.

To increase supply and adaptability, the federal government could allocate additional resources to help shorten the time it takes for agencies to review whether manufacturing plants and suppliers are up to safety codes. Contracts to purchase drugs could also incorporate incentives for companies to maintain reliable supply chains. Many shortages are also caused by manufacturing quality issues; investing in higher quality manufacturing processes could reduce the frequency of disruptions.

Unfortunately, if supplies are not adequate, drugs may be rationed or patients may not receive care. This, in effect, is at least part of what’s happening with COVID-19 testing kits, where demand is much higher than supply.

Source: Read Full Article